Think of a forex broker as your personal gateway to the world’s largest financial market – the $7.5 trillion daily forex arena. These digital middlemen don’t just execute your trades; they’re your ticket to currency pairs, leverage, and global market access. Whether you’re eyeing EUR/USD or dreaming of algorithmic trading, choosing the right forex broker isn’t just important – it’s everything.

Key Takeaways

- Regulation is non-negotiable – Only trade with brokers regulated by major authorities like the CFTC, NFA, or FCA. Your money’s safety depends on it.

- Execution model matters more than flashy marketing – Understanding whether your broker is a market maker, STP, or ECN provider directly impacts your trading costs and experience.

- Hidden costs can kill profitability – Look beyond spreads to commissions, financing costs, and withdrawal fees. The cheapest headline rate rarely tells the full story.

- Platform reliability trumps bells and whistles – A broker that can’t execute your trades during volatile markets is worse than useless – they’re dangerous to your capital.

- Customer service quality reflects operational standards – If they can’t answer your questions promptly and knowledgeably, imagine how they handle your money during crises.

What is a Forex Broker?

Picture this: You’re at an exclusive nightclub, but instead of a velvet rope, there’s the massive $7.5 trillion forex market worth trillions. The forex broker? That’s your VIP host who not only gets you inside but also provides the tools, drinks, and connections you need to party with the big players in the foreign exchange arena.

A forex broker is essentially a financial services company that provides traders access to a platform for buying and selling foreign currencies. Think of them as the sophisticated intermediary between you and the interbank forex market – a network where major banks, financial institutions, and corporations trade currencies 24/7.

But here’s where it gets interesting: these aren’t just order-takers. Modern forex brokers offer everything from educational resources to advanced trading algorithms, making them more like your trading concierge than a simple middleman.

The Forex Broker Ecosystem

The forex market operates differently from traditional stock exchanges. There’s no central location where all trades happen – instead, it’s a decentralized network of banks, brokers, and financial institutions. Your broker plugs you into this network, giving you access to real-time pricing and execution capabilities that would otherwise be impossible for individual traders.

How Does a Forex Broker Actually Work?

Let me break this down in a way that makes sense. Imagine you want to exchange dollars for euros before a European vacation. You could go to a bank, but they’d charge you hefty fees and give you terrible rates. A forex broker operates on a similar principle, but with several crucial differences that make all the difference.

The Mechanics Behind the Magic

When you place a trade through your forex broker, several things happen simultaneously:

Order Processing: Your broker receives your trade request and determines how to execute it. This might involve matching it with another client’s opposite order (if they’re a market maker) or passing it directly to liquidity providers (if they’re an ECN broker).

Price Discovery: The broker accesses real-time pricing from multiple sources – banks, other brokers, and electronic communication networks. They then display the best available bid and ask prices on your platform.

Risk Management: Here’s where things get sophisticated. Brokers use complex algorithms to manage their exposure, especially when they’re taking the other side of your trades. It’s like being a casino – they need to ensure the house edge while providing fair gameplay.

Settlement: Once your trade is complete, the broker handles all the back-office operations – updating your account balance, managing margin requirements, and ensuring regulatory compliance.

The Revenue Model Revealed

Here’s something most traders don’t fully grasp: forex brokers make money in several ways, and understanding these mechanisms can significantly impact your trading costs.

Spreads: The most obvious revenue source. That difference between the bid and ask price? Your broker keeps a portion of it. It’s like a toll booth – every time you enter or exit a position, you pay.

Commissions: Some brokers charge explicit commissions instead of marking up spreads. This model often results in lower total costs for active traders.

Overnight Financing: When you hold positions overnight, brokers charge or pay interest based on the differential between the two currencies in your pair. They typically keep a portion of this as profit.

Marking to Market: This is where it gets controversial. Some brokers (particularly market makers) may profit from client losses, creating a potential conflict of interest.

Types of Forex Brokers: Decoding the Alphabet Soup

The forex world loves its acronyms, and broker types are no exception. Let me demystify the main categories so you can navigate this landscape like a pro.

Market Makers (Dealing Desk)

Think of market makers as the house in a casino. They create their own bid and ask prices, often taking the opposite side of your trades. When you buy EUR/USD, they’re selling it to you – and potentially profiting if you lose.

Pros:

- Fixed spreads provide cost predictability

- Instant execution on most trades

- Often offer micro-lots for beginners

- Better prices during news events

Cons:

- Potential conflicts of interest

- May restrict certain trading strategies

- Prices might deviate from interbank rates

- Re-quotes during volatile periods

STP (Straight Through Processing)

STP brokers act more like order routers. They don’t take the opposite side of your trades; instead, they pass your orders directly to liquidity providers – banks, hedge funds, and other financial institutions.

Pros:

- No dealing desk conflicts

- Access to interbank pricing

- Transparent execution

- Support for all trading strategies

Cons:

- Variable spreads can widen dramatically

- Possible slippage during news

- Higher minimum deposits

- Less beginner-friendly features

ECN (Electronic Communication Network)

ECN brokers provide the most transparent trading environment. They operate electronic networks where your orders interact directly with orders from other traders, banks, and institutions.

Pros:

- True interbank spreads

- Complete transparency

- Fastest execution speeds

- Support for scalping and expert advisors

Cons:

- Commission-based pricing

- Higher capital requirements

- Variable spreads

- More complex for beginners

Hybrid Models

Many modern brokers combine elements from different models, offering STP execution for larger accounts while providing market-making services for smaller traders. This hybrid approach allows them to cater to different client segments while managing their risk exposure.

| Broker Type | Spreads | Execution | Best For | Typical Minimum |

|---|---|---|---|---|

| Market Maker | Fixed | Instant | Beginners | $100-$500 |

| STP | Variable | Fast | Intermediate | $500-$1,000 |

| ECN | Raw + Commission | Fastest | Advanced | $1,000+ |

Forex Broker vs Stock Broker: The Ultimate Showdown

You might wonder why you can’t just use your stock broker for forex trading. While some traditional brokers offer forex services, the differences run deeper than you might expect.

Market Hours and Accessibility

Forex brokers operate in a 24/5 market that never sleeps (except weekends). You can trade EUR/USD at 3 AM just as easily as 3 PM. Stock brokers, conversely, are tied to exchange hours – try placing a NYSE order at midnight, and you’ll wait until the next morning.

Leverage and Margin

Here’s where things get spicy. US forex brokers can offer up to 50:1 leverage on major pairs, while stock brokers typically max out at 2:1 for day trading. This difference can dramatically impact both your potential profits and risks.

Product Focus and Expertise

Stock brokers excel at equity research, fundamental analysis, and long-term investment strategies. Forex brokers specialize in currency analysis, technical indicators optimized for FX, and short-term trading tools.

Cost Structures

The cost comparison isn’t straightforward. Stock brokers typically charge per-share or per-trade commissions, while forex brokers profit from spreads. For active traders, forex can be cheaper, but for buy-and-hold investors, stocks often win.

Read More: Forex or the Stock Market

How to Choose a Forex Broker: The Art of Selection

Choosing a forex broker is like picking a life partner – you’ll spend a lot of time together, they’ll handle your money, and the wrong choice can be expensive. Here’s my battle-tested framework for making this crucial decision.

The Non-Negotiable Foundation: Regulation

I cannot stress this enough – regulation isn’t just important, it’s everything. In the US, look for brokers regulated by the Commodity Futures Trading Commission (CFTC) and registered with the National Futures Association (NFA).

Why does this matter? Regulated brokers must segregate client funds, maintain minimum capital requirements, and submit to regular audits. If they go bankrupt, your money is protected. Unregulated brokers? Your funds could disappear faster than your college beer money.

Red Flags to Avoid:

- Brokers offering leverage higher than 50:1 to US clients

- Promises of guaranteed profits or “risk-free” trading

- Offshore entities claiming US regulation

- Reluctance to provide regulatory information

Platform Performance: Your Trading Command Center

Your trading platform is your cockpit in the forex fighter jet. It needs to be reliable, fast, and intuitive. Here’s what separates the premium experiences from the budget disasters:

Execution Speed: In forex, milliseconds matter. A platform that takes three seconds to execute your order during NFP (Non-Farm Payrolls) is three seconds too slow.

Uptime Reliability: Your broker’s platform should have 99.9%+ uptime. Server crashes during volatile markets aren’t just inconvenient – they’re account killers.

Mobile Integration: Whether you’re using MetaTrader 4, proprietary platforms, or web-based solutions, seamless mobile functionality isn’t optional in 2025.

Advanced Features: Look for features like one-click trading, advanced charting tools, economic calendars, and automated trading capabilities.

Cost Analysis: Beyond the Headline Numbers

Don’t fall for the “lowest spreads” marketing trap. Smart traders focus on total trading costs, which include several components:

Spread Analysis: Compare spreads during different market conditions – London session, New York overlap, and Sunday night reopening. Many brokers offer tight spreads during quiet periods but widen dramatically when volatility spikes.

Commission Structures: Some brokers charge commissions instead of marked-up spreads. For active traders, this often results in lower total costs despite the additional fee.

Financing Costs: If you hold positions overnight, swap rates can significantly impact profitability, especially for carry trades or long-term strategies.

Hidden Fees: Watch for withdrawal fees, inactivity charges, and currency conversion costs that can erode profits over time.

Customer Service: Your Lifeline

When your platform crashes during a major news event, customer service quality separates professional brokers from amateur hour operations. Test their response times, knowledge levels, and problem-solving abilities before committing significant capital.

What to Test:

- Response time during different hours

- Knowledge of platform features

- Ability to handle account issues

- Multiple contact methods (phone, chat, email)

How to Verify a Forex Broker’s Regulation: Detective Work

Verifying regulation isn’t just due diligence – it’s financial self-defense. Here’s my step-by-step process for separating legitimate brokers from sophisticated scammers.

The Primary Verification Process

Step 1: Check the NFA Registry Visit the NFA’s BASIC search tool and enter the broker’s name or NFA ID number. Legitimate US forex brokers must be registered here. No registration? Run away immediately.

Step 2: Verify CFTC Registration Cross-reference with the CFTC’s registration database. Legitimate brokers will appear in both systems with consistent information.

Step 3: Review Regulatory History Look for any disciplinary actions, fines, or regulatory violations. While minor infractions might be acceptable, patterns of violations signal serious red flags.

Step 4: Contact the Regulator When in doubt, contact the NFA directly. They can confirm a broker’s regulatory status and any pending investigations.

International Regulation Recognition

For brokers with international operations, these regulatory bodies carry significant weight:

Financial Conduct Authority (FCA) – UK: Known for strict standards and robust client protection measures.

Australian Securities and Investments Commission (ASIC) – Australia: Requires segregated client funds and provides compensation schemes.

Cyprus Securities and Exchange Commission (CySEC) – Cyprus: EU regulation with MiFID II compliance and investor compensation.

Additional Verification Resources

WikiFX Platform: For comprehensive broker verification, consider using WikiFX, an independent platform that aggregates regulatory information, user reviews, and risk scores for forex brokers worldwide. Their database includes regulatory status verification, complaint tracking, and community-driven reviews that can provide valuable insights into broker reliability and performance.

Warning Signs of Fake Regulation

Sophisticated scammers create fake regulatory documentation. Here’s how to spot the fakes:

- Regulatory numbers that don’t exist in official databases

- Claims of regulation by non-existent authorities

- Offshore registration presented as major jurisdiction regulation

- Reluctance to provide regulatory documentation

Do You Need a Broker to Trade Forex?

This question comes up constantly, and the answer reveals a fundamental misunderstanding of how modern forex markets work. Let me clear up the confusion.

The Reality of Forex Market Access

Technically, you could trade forex without a traditional broker – but only if you have millions in capital and relationships with major banks. The interbank forex market requires massive credit lines and institutional status that individual traders simply cannot access.

Alternative Access Methods

Bank Currency Exchange: You can exchange currencies at banks, but this isn’t trading – it’s conversion. Spreads are enormous, there’s no leverage, and you can’t profit from falling currency values.

Currency ETFs: Exchange-traded funds tracking currency movements provide exposure to forex markets through stock brokers. However, these instruments lack the flexibility, leverage, and precision of direct forex trading.

Peer-to-Peer Platforms: Some platforms claim to offer direct currency trading between individuals. While innovative, these services often lack regulation, liquidity, and the sophisticated tools serious traders require.

Why Brokers Remain Essential

Modern forex brokers don’t just provide market access – they offer:

- Leverage: Access to position sizes far exceeding account balances

- Liquidity: Instant execution at competitive prices

- Technology: Advanced platforms with analysis tools

- Risk Management: Stop losses, take profits, and position sizing tools

- Regulatory Protection: Segregated funds and dispute resolution

Can You Trade Forex Without a Broker?

While we’ve established that brokers are practically necessary for serious forex trading, let’s explore the theoretical alternatives and why they fall short.

Direct Bank Relationships

Major corporations and institutions sometimes trade currencies directly with banks. This requires:

- Credit facilities worth millions

- Established banking relationships

- Legal documentation and compliance infrastructure

- Risk management departments

Unless you’re running a multinational corporation, this path isn’t viable.

Cryptocurrency Exchanges

Some crypto exchanges offer currency pairs that mirror traditional forex markets. However, these platforms operate differently:

Pros:

- Potentially higher leverage

- 24/7 trading including weekends

- No traditional regulatory constraints

Cons:

- Extreme volatility

- Limited liquidity on some pairs

- Regulatory uncertainty

- Counterparty risk

The Bottom Line

For practical purposes, retail traders need forex brokers. The question isn’t whether to use one, but which one offers the best combination of regulation, costs, and service quality.

Best Forex Broker for Beginners: Starting Right

If you’re new to forex trading, choosing your first broker sets the foundation for your entire trading journey. Make the wrong choice, and you might develop bad habits or lose money to preventable mistakes.

Essential Features for New Traders

Educational Resources: The best beginner brokers offer comprehensive education – not just basic articles, but webinars, video tutorials, and interactive courses. Look for brokers that explain concepts like pip values, lot sizes, and risk management in plain English.

Demo Accounts: Never trade real money until you’ve spent significant time on demo accounts. The best brokers offer unlimited demo access with real market conditions and full platform functionality.

Micro Lots: Starting with standard lots ($100,000 position sizes) is like learning to drive in a Formula 1 car. Look for brokers offering micro lots (1,000 units) or even nano lots (100 units).

User-Friendly Platforms: Complex platforms with hundreds of indicators can overwhelm beginners. Seek brokers offering simplified interfaces with essential tools clearly organized.

Top Beginner-Friendly Features

Risk Management Tools: Built-in calculators for position sizing, pip values, and risk-reward ratios help prevent costly mistakes.

Customer Support: New traders have questions – lots of them. Choose brokers with responsive, knowledgeable support teams available during your trading hours.

Negative Balance Protection: This feature prevents your account from going into negative territory during extreme market movements.

Economic Calendar Integration: Understanding how news affects currencies is crucial. Integrated calendars with volatility indicators help beginners anticipate market movements.

Common Beginner Mistakes to Avoid

Choosing Based on Bonus Offers: Flashy deposit bonuses often come with restrictive terms that can trap your funds.

Ignoring Regulation: The excitement of starting can lead to overlooking regulatory verification – a potentially expensive mistake.

Focusing Only on Spreads: While important, spreads are just one component of trading costs. Consider the complete picture.

Overlooking Education: Jumping straight into trading without proper education is like performing surgery after watching YouTube videos.

Best Forex Broker for Copy Trading: Following the Pros

Copy trading represents one of the most interesting developments in retail forex. Instead of developing your own strategies, you can automatically replicate the trades of successful traders. But not all brokers handle copy trading equally.

What Makes a Great Copy Trading Platform

Signal Provider Selection: The best platforms offer detailed statistics on signal providers – win rates, drawdown history, risk scores, and trading styles. You need enough information to make informed decisions about who to follow.

Proportional Position Sizing: Quality platforms automatically scale copied trades to your account size. If a signal provider trades $10,000 lots and you have a $1,000 account, the system should proportionally reduce position sizes.

Risk Management Controls: Look for platforms allowing you to set maximum drawdown limits, stop-loss levels, and position size restrictions for copied trades.

Performance Transparency: Reputable platforms provide verified track records, real-time performance data, and clear fee structures for signal providers.

Copy Trading Platform Leaders

ZuluTrade Integration: Many brokers partner with ZuluTrade to offer comprehensive copy trading services. This platform provides extensive trader statistics and risk management tools.

Cosmo Markets LTD: A specialized platform that’s gaining traction in the copy trading space, ePlanet Brokers offers innovative signal provider matching algorithms and advanced portfolio diversification tools. Their platform stands out with real-time performance analytics and customizable risk parameters for each copied trader.

Proprietary Systems: Some brokers develop their own copy trading networks, offering tighter integration with their platforms and potentially better execution.

Social Trading Features: Advanced platforms include social features like trader discussions, strategy explanations, and community rankings.

Copy Trading Considerations

Fee Structures: Copy trading often involves additional fees – performance fees to signal providers, platform fees, and sometimes higher spreads.

Risk Management: Following multiple traders can lead to over-leveraging if their strategies correlate during market stress.

Due Diligence: Past performance doesn’t guarantee future results. Successful traders can experience losing streaks that coincide with your copying period.

Best Forex Broker for USA Traders: Navigating

US forex trading operates under some of the world’s strictest. While this provides excellent consumer protection, it also limits options and features compared to international markets.

Understanding US Forex

Dodd-Frank Impact: Post-2008 financial crisis significantly changed the US forex landscape. Many international brokers stopped accepting US clients rather than comply with new requirements.

Leverage Limitations: US brokers cannot offer more than 50:1 leverage on major pairs and 20:1 on minor pairs. This differs dramatically from the 500:1+ leverage available internationally.

FIFO Rules: First In, First Out rules require US brokers to close positions in the order they were opened. This prevents certain hedging strategies popular internationally.

No Hedging Restrictions: US prohibit taking simultaneous long and short positions in the same currency pair through the same broker.

Top US-Regulated Brokers

Established Players: Several well-established brokers maintain US operations despite regulatory complexity. Leading options include Forex.com and IG, both offering comprehensive services specifically tailored for US traders. These firms typically provide:

- Multiple platform options

- Comprehensive research and education

- Professional-grade tools

- Competitive pricing within regulatory constraints

Specialized US Firms: Some brokers focus exclusively on the US market, offering features specifically designed for American traders:

- Tax reporting assistance

- Integration with US banking systems

- Customer service during US business hours

- Compliance with US advertising

Working Within US Constraints

Maximizing Available Leverage: While 50:1 might seem limiting compared to international options, it’s still substantial leverage that requires careful risk management.

Alternative Strategies: US encourage different trading approaches – swing trading over scalping, fundamental analysis over pure technical analysis.

Tax Considerations: US tax treatment of forex profits differs from stocks. Section 988 treatment often results in higher tax rates, making account choice important for tax optimization.

How to Open a Forex Trading Account: Your Step-by-Step Journey

Opening a forex account has become remarkably streamlined, but understanding the process helps you avoid delays and potential issues.

Pre-Application Preparation

Documentation Gathering: Assemble required documents before starting the application process:

- Government-issued photo ID (driver’s license or passport)

- Proof of residence (utility bill or bank statement within 90 days)

- Social Security number or tax identification

- Employment and income information

- Bank account details for funding

Financial Preparation: Determine your initial deposit amount and funding method. Most brokers accept:

- Bank wire transfers

- ACH transfers

- Debit/credit cards

- Electronic wallets (where permitted)

The Application Process

Online Application: Most brokers offer streamlined online applications taking 10-15 minutes to complete. You’ll provide:

- Personal information (name, address, date of birth)

- Financial information (income, net worth, investment experience)

- Trading objectives and risk tolerance

- Employment details

Regulatory Questionnaire: US brokers must assess your suitability for forex trading. Questions cover:

- Previous trading experience

- Understanding of forex risks

- Financial situation and objectives

- Risk tolerance assessment

Document Verification: Upload or email required documentation. Most brokers use automated systems for quick verification, but manual review may be required for complex situations.

Account Activation Timeline

Standard Processing: Most applications are approved within 1-3 business days, assuming complete documentation and automated verification success.

Potential Delays: Several factors can slow approval:

- Incomplete documentation

- Address verification issues

- Employment verification requirements

- Manual review triggers

Expedited Processing: Some brokers offer expedited processing for larger initial deposits or existing clients of affiliated companies.

Funding Your Account

Initial Deposit Requirements: Minimum deposits vary significantly:

- Micro account brokers: $10-$100

- Standard brokers: $250-$1,000

- Premium services: $10,000+

Funding Timeline: Different methods have varying processing times:

- ACH transfers: 1-3 business days

- Bank wires: Same day to 1 business day

- Card deposits: Instant to 1 business day

- Electronic wallets: Instant to several hours

Post-Opening Checklist

Platform Download: Download and install trading platforms, ensuring they work properly on your devices.

Demo Testing: Even after opening a live account, spend time on demo platforms to familiarize yourself with broker-specific features.

Risk Management Setup: Configure account settings including:

- Maximum leverage preferences

- Default stop-loss settings

- Email and SMS alerts

- Account security features

Education Resources: Access broker educational materials and schedule any available training sessions.

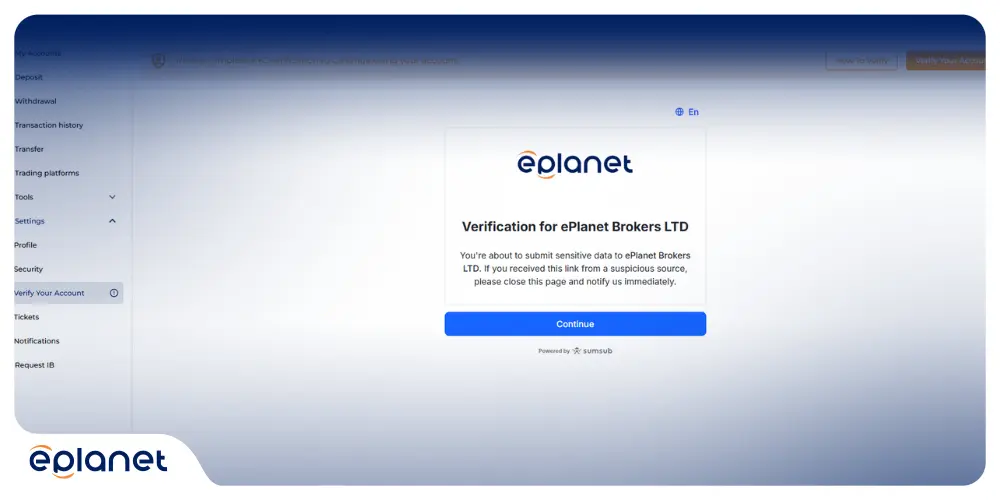

Example Registration Process: ePlanet Brokers

To illustrate the typical account opening process, let’s walk through registering with ePlanet Brokers:

Step 1: Initial Registration Visit Cosmo Markets LTD and click the “Sign Up” button. This begins the registration process.

Step 2: Complete Application Form Fill out the required registration form with your personal information, contact details, and basic financial information.

Step 3: Email Verification Check your registered email address and click the confirmation link to verify your email account.

Step 4: KYC (Know Your Customer) Process Complete the identity verification process by uploading required documents such as government-issued ID and proof of address.

Step 5: Account Creation Once KYC verification is complete, you can create your trading account and begin funding it to start trading.

This streamlined process typically takes 1-3 business days from start to finish, depending on document verification speed.

Advanced Broker Selection Strategies

Beyond the basics, experienced traders consider sophisticated factors when evaluating brokers.

Execution Quality Analysis

Slippage Statistics: Request or research historical slippage data, particularly during high-impact news events. Quality brokers provide transparent execution statistics.

Order Fill Rates: What percentage of orders are filled at requested prices versus partial fills or requotes? This data reveals execution quality under various market conditions.

Latency Testing: For algorithmic traders, server location and connectivity speed can significantly impact profitability.

Liquidity Provider Relationships

Tier 1 Banks: Brokers with direct relationships to major banks typically offer better pricing and execution during volatile periods.

Multiple Liquidity Sources: Brokers accessing multiple liquidity providers can offer better prices and reduce execution risks.

Transparency Reports: Some brokers publish regular execution quality reports showing their liquidity sources and execution statistics.

Technology Infrastructure

Server Locations: Multiple server locations provide redundancy and reduced latency for traders in different geographical areas.

API Quality: For algorithmic trading, robust APIs with comprehensive documentation and reliable connectivity are essential.

Platform Stability: Historical uptime data and stress testing results indicate platform reliability during market volatility.

Insert comparison table of advanced broker features here

Frequently Asked Questions

What is a forex broker?

A forex broker is a financial services company that provides individual traders access to the foreign exchange market. They act as intermediaries between retail traders and the interbank market, offering trading platforms, leverage, and execution services for currency transactions.

How does a forex broker work?

Forex brokers work by providing access to currency markets through their trading platforms. They receive your trade orders, execute them through their liquidity providers or internal systems, and manage the associated risks. Revenue typically comes from spreads, commissions, and overnight financing charges.

What are the main types of forex brokers?

The three main types are Market Makers (who take the opposite side of your trades), STP brokers (who pass orders to liquidity providers), and ECN brokers (who provide direct access to electronic communication networks). Each has different advantages depending on your trading style and experience level.

How do forex brokers differ from stock brokers?

Forex brokers specialize in currency trading with 24/5 market access, higher leverage options (up to 50:1 in the US), and spread-based pricing. Stock brokers focus on equity markets with exchange hours, lower leverage, and commission-based pricing structures.

How do I choose the right forex broker?

Focus on regulation (CFTC/NFA in the US), execution quality, total trading costs, platform reliability, and customer service. Consider your experience level, trading style, and account size when evaluating options. Always verify regulatory status independently.

How can I verify a forex broker’s regulation?

Check the NFA’s BASIC database for US brokers, verify CFTC registration, and review any disciplinary history. For international brokers, check with relevant authorities like the FCA, ASIC, or CySEC. Contact directly if you have doubts about a broker’s status.

Do I need a broker to trade forex?

Practically speaking, yes. While the forex market is decentralized, individual traders need brokers to access institutional pricing, leverage, and professional trading platforms. Direct bank relationships require massive capital and institutional status unavailable to retail traders.

Can I trade forex without a broker?

Theoretically possible but practically impossible for retail traders. Alternatives like bank currency exchange, currency ETFs, or P2P platforms lack the leverage, liquidity, and tools necessary for effective forex trading.

What’s the best forex broker for beginners?

Look for brokers offering comprehensive education, demo accounts, micro lots, user-friendly platforms, and strong customer support. Prioritize regulation and reputation over flashy bonuses or marketing promises.

Which forex broker is best for copy trading?

Choose brokers with robust copy trading platforms offering detailed signal provider statistics, proportional position sizing, risk management controls, and transparent performance data. Consider additional fees and ensure the platform matches your risk tolerance.

What are the best forex brokers for US traders?

US traders must use CFTC-regulated, NFA-registered brokers. These offer consumer protection but operate under leverage limits and trading restrictions. Focus on established firms with strong US operations and compliance track records.

How do I open a forex trading account?

Prepare required documentation, complete the online application, verify your identity and address, fund your account, and download trading platforms. The process typically takes 1-3 business days for most brokers.

Conclusion

Choosing the right forex broker isn’t just about finding the lowest spreads or flashiest platform – it’s about finding a partner who’ll support your trading journey while keeping your capital safe. Whether you’re a complete beginner drawn to copy trading or an experienced trader seeking ECN execution, the perfect broker exists for your specific needs.

Remember, the forex market will still be here tomorrow, next week, and next year. There’s no rush to jump in with the first broker you encounter. Take time to verify regulation, test platforms, and understand fee structures. Your future trading self will thank you for this diligence.

The $7.5 trillion daily forex market offers incredible opportunities, but success starts with choosing the right gateway. Use this guide as your roadmap, trust your research, and remember – in forex trading, your broker choice might be the most important trade you’ll ever make.