Timeframes are the lens through which forex traders view market movements, determining everything from entry signals to risk management strategies. Whether you’re scalping for quick profits or swing trading for larger moves, understanding how different timeframes affect price action, liquidity, and trading opportunities can transform your trading performance and help you align your strategy with your lifestyle and risk tolerance.

Key Takeaways

- Timeframe selection directly impacts your trading style – scalpers thrive on 1-5 minute charts, while position traders rely on daily and weekly timeframes.

- Higher timeframes provide stronger signals with less noise – but require more patience and larger stop losses.

- Multiple timeframe analysis creates a complete market picture – use higher timeframes for direction and lower ones for precise entries.

- Liquidity varies significantly across timeframes – major currency pairs offer better execution on shorter timeframes during active market hours.

- Your lifestyle should dictate your primary timeframe – day jobs require different approaches than full-time trading.

Introduction

Picture this: You’re staring at your trading screen, watching EUR/USD bounce around like a ping-pong ball on the 1-minute chart. Your heart races with every tick. Then you zoom out to the daily chart, and suddenly, that chaotic movement looks like a gentle wave in an ocean of trend. Welcome to the fascinating world of timeframes – where perspective literally changes everything.

I’ve been trading forex for over a decade, and I can tell you that mastering timeframes is like learning to speak multiple languages fluently. Each timeframe tells its own story, reveals different patterns, and offers unique opportunities. The 5-minute chart whispers secrets about immediate price action, while the monthly chart shouts long-term market direction.

But here’s the thing – most traders get this wrong. They either get lost in the noise of lower timeframes or miss golden opportunities by sticking only to higher ones. The magic happens when you understand how to dance between different timeframes, using each for what it does best.

Understanding Timeframes: The Foundation of Smart Trading

What is a Timeframe in Trading?

A timeframe in forex trading represents the duration each candlestick or bar covers on your chart. Think of it as your trading telescope – adjust the lens, and you see different aspects of the same market reality. A 1-minute chart shows 1,440 candles per day, each representing one minute of price action. Meanwhile, a daily chart condenses that entire day into a single candle.

The beauty lies in how each timeframe reveals different market characteristics. I remember when I first started trading, I was glued to the 1-minute chart, trying to catch every small move. It was like trying to navigate a city by staring at my feet instead of looking at street signs. Once I learned to step back and see the bigger picture, my trading transformed completely.

What are Timeframes in Forex?

Forex timeframes range from the ultra-short tick charts to monthly views that span years of data. Here’s how they break down:

Ultra-Short Timeframes (Tick to 5-minute):

- Tick charts: Real-time price changes

- 1-minute: 1,440 candles per day

- 5-minute: 288 candles per day

Short Timeframes (15-minute to 1-hour):

- 15-minute: 96 candles per day

- 30-minute: 48 candles per day

- 1-hour: 24 candles per day

Medium Timeframes (4-hour to Daily):

- 4-hour: 6 candles per day

- Daily: 1 candle per day

Long Timeframes (Weekly to Monthly):

- Weekly: 1 candle per week

- Monthly: 1 candle per month

Each category serves different trading personalities and strategies. The key is matching your timeframe to your goals, available time, and risk tolerance.

The Importance of Timeframe in Trading: Why It’s Your Secret Weapon

Market Noise vs. Meaningful Signals

Let me share something that changed my trading game forever. Early in my career, I was that trader who’d see a “perfect” setup on the 5-minute chart, only to watch it get steamrolled by the opposite trend on the daily. It was like trying to swim upstream – technically possible but exhaustingly inefficient.

The importance of timeframe selection goes beyond just seeing price movements. It’s about filtering market noise from meaningful signals. Higher timeframes act like noise-canceling headphones for traders – they help you focus on what matters while blocking out the distracting chatter of minor price fluctuations.

Risk Management Across Timeframes

Different timeframes require dramatically different risk management approaches. A scalper might risk 5-10 pips with a 2-3 pip profit target, while a daily chart trader might risk 100 pips for a 300-pip target. Neither approach is wrong – they’re optimized for their respective timeframes.

| Timeframe | Typical Stop Loss | Typical Target | Win Rate Expectation |

|---|---|---|---|

| 1-5 minutes | 3-10 pips | 5-15 pips | 60-70% |

| 15-30 minutes | 10-25 pips | 20-50 pips | 50-60% |

| 1-4 hours | 25-75 pips | 75-200 pips | 40-50% |

| Daily+ | 75-200 pips | 200-500 pips | 35-45% |

This table illustrates a crucial trading principle: shorter timeframes typically offer higher win rates but smaller profit-to-risk ratios, while longer timeframes provide larger moves but require more patience and tolerance for drawdowns.

Best Timeframe for Scalping

The Scalper’s Paradise: 1-5 Minute Charts

Scalping is like being a forex sniper – you need precision, speed, and nerves of steel. The best timeframes for scalping are the 1-minute and 5-minute charts, with some traders venturing into 15-minute territory for slightly longer holds.

I’ve watched master scalpers work, and it’s poetry in motion. They enter and exit positions within minutes, sometimes seconds, capturing small but consistent profits. The key isn’t just the timeframe choice – it’s understanding when these short timeframes provide the clearest signals.

Prime Scalping Hours:

- London Open: 3:00-6:00 AM EST

- New York Open: 8:00-11:00 AM EST

- London-New York Overlap: 8:00 AM-12:00 PM EST

During these periods, major pairs like EUR/USD, GBP/USD, and USD/JPY offer the highest liquidity and tightest spreads, making scalping more profitable.

Scalping Strategy Essentials

The 1-5 minute timeframes work best for scalping because they provide enough price movement to capture profits while maintaining high trade frequency. Here’s what makes these timeframes ideal:

Volume and Liquidity: Short timeframes during active sessions offer maximum liquidity, ensuring your orders get filled at expected prices without significant slippage.

Technical Patterns: Quick reversal patterns, support/resistance bounces, and momentum breaks are clearly visible and actionable on these timeframes.

News Reaction: Major economic announcements create immediate volatility that scalpers can exploit within minutes of release.

However, scalping isn’t for everyone. It requires intense focus, quick decision-making, and the ability to handle rapid-fire losses without emotional distress. I’ve seen excellent swing traders fail miserably at scalping simply because the psychological demands were too different.

Best Timeframe for Forex Beginners

The Sweet Spot: 1-Hour and 4-Hour Charts

If you’re new to forex trading, I have one piece of advice that could save you months of frustration: start with the 1-hour and 4-hour timeframes. These are the Goldilocks zones of forex trading – not too fast, not too slow, but just right for learning.

Here’s why these timeframes are perfect for beginners:

Manageable Pace: Unlike scalping, you have time to think, analyze, and make decisions without panic. A trade setup on the 4-hour chart might take several hours to play out, giving you breathing room.

Clear Patterns: Technical analysis patterns are more reliable and easier to spot on these timeframes. Support and resistance levels, trend lines, and chart patterns have more significance.

Reasonable Risk: Stop losses are typically 30-80 pips, which is substantial enough to avoid getting stopped out by normal market noise but not so large that a few losses wipe out your account.

Learning Curve Advantages

When I mentor new traders, I always start them on these intermediate timeframes because they offer the best learning environment:

Mistake Recovery: If you enter a trade slightly early or late, there’s often time for the market to move in your favor anyway.

Pattern Recognition: You’ll develop a keen eye for setups without getting overwhelmed by the constant movement of shorter timeframes.

Risk Management Practice: You can practice position sizing and stop-loss placement without the pressure of split-second decisions.

A beginner should spend at least 3-6 months mastering these timeframes before attempting to scalp or swing trade on daily charts. Trust me, this foundation will serve you well throughout your trading career.

Timeframe and Liquidity in Trading: The Hidden Connection

Understanding Market Liquidity Across Time

Liquidity in forex isn’t constant – it flows like a river, sometimes rushing, sometimes trickling. The relationship between timeframes and liquidity is one of those “aha!” moments that separate struggling traders from successful ones.

During the London session (3:00 AM – 12:00 PM EST), EUR/USD might see 10-15 pip ranges on 5-minute charts with tight spreads and instant execution. But during the Asian session, that same timeframe might show 2-3 pip ranges with wider spreads and potential slippage.

High Liquidity Periods:

- Sydney-Tokyo Overlap: 7:00 PM – 2:00 AM EST

- London Session: 3:00 AM – 12:00 PM EST

- New York Session: 8:00 AM – 5:00 PM EST

- London-New York Overlap: 8:00 AM – 12:00 PM EST (Peak liquidity)

Impact on Different Trading Styles

The liquidity-timeframe relationship affects your trading in ways you might not realize:

Scalping Impact: Low liquidity periods can turn profitable scalping strategies into break-even or losing propositions due to wider spreads and slippage.

Swing Trading Advantage: Higher timeframe traders are less affected by liquidity variations since they’re looking for larger moves that transcend individual sessions.

Breakout Trading: The most reliable breakouts often occur during high-liquidity periods when there’s enough volume to sustain momentum.

I learned this lesson the hard way during my second year of trading. I had a fantastic scalping strategy that worked beautifully during London hours but lost money consistently during quiet Asian sessions. The timeframe hadn’t changed, but the market conditions had.

Timeframe Adjustment for News Trading

The News Trading Timeframe Strategy

News trading is like surfing – you need to catch the wave at just the right moment with the right board (timeframe). Major economic announcements create immediate volatility that ripples across all timeframes, but the optimal approach varies significantly.

Pre-News Setup (15-minute to 1-hour charts): Before major announcements like NFP, FOMC decisions, or GDP releases, I analyze 15-minute to 1-hour charts to identify key levels where price might react. These timeframes show recent consolidation patterns and critical support/resistance zones.

News Release Reaction (1-minute to 5-minute charts): The moment news hits, I switch to 1-5 minute charts to catch the initial reaction. This is where fortunes are made and lost in minutes. The key is having predetermined levels and being ready to act instantly.

Post-News Follow-through (15-minute to 4-hour charts): After the initial spike, I zoom out to see if the move has staying power. Often, the real money is made in the follow-through move that develops over the next few hours.

News Trading Timeframe Examples

Let me walk you through a typical NFP (Non-Farm Payrolls) trading scenario:

9:25 AM EST (5 minutes before release): I’m watching the 5-minute EUR/USD chart, noting that price is consolidating between 1.0850-1.0870. Volume is building, and I can sense the market’s anticipation.

9:30 AM EST (Release moment): The number beats expectations significantly. On the 1-minute chart, USD pairs explode with volatility. EUR/USD drops 40 pips in 2 minutes.

9:35-10:30 AM EST (Follow-through period): I switch to the 15-minute chart to see if this move has legs. The break below 1.0850 support suggests further downside, and I ride the trend for another 60 pips.

The beauty of news trading lies in combining timeframes strategically. Higher timeframes provide context and direction, while lower timeframes offer precise entry and exit points.

How to Use Multiple Timeframes in Trading

The Top-Down Analysis Method

Multiple timeframe analysis is like reading a book – you need the chapter headings (higher timeframes) to understand the story, but you also need the sentences (lower timeframes) to grasp the details. I use what I call the “Rule of Four” – analyzing four timeframes for every trade decision.

Primary Timeframe: This is where I identify the main trend and major support/resistance levels. For swing trading, this might be the daily chart.

Secondary Timeframe: One level down from primary, used to refine entries and identify intermediate patterns. For daily primary, this would be the 4-hour chart.

Entry Timeframe: Two levels down from primary, used for precise entry timing. This would be the 1-hour chart in our example.

Confirmation Timeframe: Three levels down, used for final entry confirmation and initial stop-loss placement. The 15-minute chart completes our analysis.

Practical Multi-Timeframe Strategy

Here’s how I execute a typical multi-timeframe trade:

Step 1 – Weekly/Daily Analysis: I start by identifying the major trend direction and key levels. Is EUR/USD in an uptrend, downtrend, or range? Where are the significant support and resistance zones?

Step 2 – 4-Hour Refinement: On the 4-hour chart, I look for trend continuation or reversal patterns. Are we seeing higher highs and higher lows in an uptrend? Is there a potential double top forming?

Step 3 – 1-Hour Entry Setup: The 1-hour chart shows me specific entry opportunities. I’m looking for pullbacks to support in uptrends or bounces from resistance in downtrends.

Step 4 – 15-Minute Timing: Finally, the 15-minute chart helps me time my entry precisely. I want to see momentum building in my favor before pulling the trigger.

| Analysis Level | Timeframe | Purpose | Key Elements |

|---|---|---|---|

| Trend Direction | Daily/Weekly | Major trend ID | Trend lines, major S/R |

| Pattern Recognition | 4-Hour | Setup identification | Chart patterns, momentum |

| Entry Timing | 1-Hour | Precise entries | Pullbacks, breakouts |

| Fine-tuning | 15-Minute | Confirmation signals | Entry triggers, stops |

This approach has transformed my trading consistency. Instead of getting whipsawed by conflicting signals, I now have a clear hierarchy of analysis that guides every decision.

How to Choose the Right Timeframe for Trading

Matching Timeframes to Your Lifestyle

Choosing the right timeframe isn’t just about trading strategy – it’s about lifestyle compatibility. I’ve seen too many traders force themselves into timeframes that don’t match their schedule or personality, leading to stress, poor decisions, and ultimately, losses.

The Full-Time Trader: If trading is your profession, you have the luxury of choice. You can scalp during high-volatility sessions, swing trade major trends, or do both. The key is specialization – master one approach before branching out.

The Part-Time Trader: Working a day job while trading requires careful timeframe selection. The 4-hour and daily charts are your best friends because:

- Positions can be managed before work and after hours

- Less screen time required for analysis

- Overnight gaps are manageable with proper position sizing

The Weekend Warrior: Limited to evenings and weekends? Focus on daily and weekly timeframes, with position entries planned during quiet Sunday sessions before the week begins.

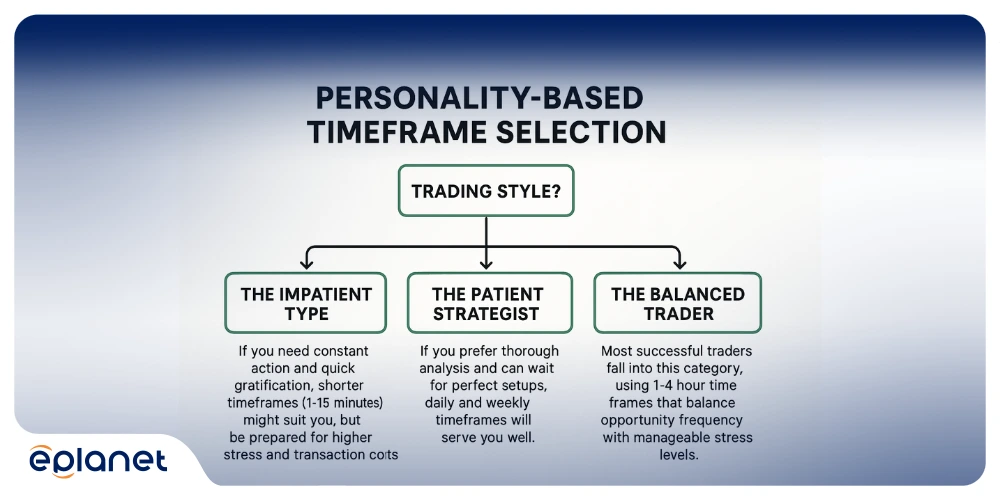

Personality-Based Timeframe Selection

Your trading timeframe should align with your psychological makeup:

The Impatient Type: If you need constant action and quick gratification, shorter timeframes (1-15 minutes) might suit you, but be prepared for higher stress and transaction costs.

The Patient Strategist: If you prefer thorough analysis and can wait for perfect setups, daily and weekly timeframes will serve you well.

The Balanced Trader: Most successful traders fall into this category, using 1-4 hour timeframes that balance opportunity frequency with manageable stress levels.

Capital Requirements by Timeframe

Different timeframes have different capital requirements due to varying stop-loss sizes and position holding periods:

Scalping (1-5 minutes): Requires larger capital relative to position size due to tight stops and high frequency trading. Minimum recommended: $5,000.

Day Trading (15-240 minutes): Moderate capital requirements with balanced risk-reward ratios. Minimum recommended: $2,500.

Swing Trading (4-hour to weekly): Can start with smaller capital due to wider stops and better risk-reward ratios. Minimum recommended: $1,000.

The key is ensuring your timeframe choice doesn’t force you into over-leveraging to generate meaningful returns.

Advanced Timeframe Strategies

The Timeframe Confluence Strategy

One of my most profitable strategies involves waiting for signals to align across multiple timeframes – what I call “timeframe confluence.” When the stars align across different time horizons, the probability of success increases dramatically.

Example Setup:

- Monthly: Clear uptrend in EUR/USD

- Weekly: Pullback to rising 20-week moving average

- Daily: Bullish engulfing candle at support

- 4-Hour: Break above consolidation pattern

- 1-Hour: Momentum confirmation with RSI above 50

When all these elements align, I have tremendous confidence in the trade’s probability of success. It might happen only 2-3 times per month per currency pair, but the success rate is typically above 70%.

The Fractal Nature of Markets

Markets are fractal – patterns repeat across different timeframes. A head and shoulders pattern on the 5-minute chart has the same implications as one on the daily chart, just with different profit potential and time horizons.

Understanding this fractal nature allows you to:

- Recognize patterns faster across timeframes

- Set appropriate profit targets based on timeframe

- Understand when patterns are more reliable (higher timeframes generally more reliable)

Timeframe-Specific Indicators

Different indicators work better on different timeframes:

Short Timeframes (1-15 minutes):

- Stochastic oscillator for overbought/oversold conditions

- Bollinger Bands for volatility-based entries

- Volume indicators for confirmation

Unlock the Strategy: Mastering the Best EMA for 5 Minute Charts

Medium Timeframes (30-240 minutes):

Long Timeframes (Daily+):

- Ichimoku cloud for comprehensive trend analysis

- Weekly/monthly pivots for major support/resistance

- Fundamental analysis integration

Common Timeframe Mistakes and How to Avoid Them

The Timeframe Hopping Trap

This is the mistake I see most often: traders constantly switching timeframes when their current view doesn’t confirm their bias. They’ll see a bullish setup on the 4-hour chart, but when it starts moving against them, they’ll zoom into the 15-minute chart looking for reasons to stay in the trade.

The Solution: Establish your primary timeframe before entering any trade and stick to it. Your entry, stop-loss, and profit target should all be based on this timeframe’s signals.

The Analysis Paralysis Problem

Some traders analyze so many timeframes that they never actually trade. They’re waiting for all timeframes to align perfectly, which rarely happens in real markets.

The Solution: Use the “Rule of Three” – analyze only three timeframes maximum for any single trade. More than that leads to conflicting signals and delayed decisions.

The Timeframe Mismatch Error

Using indicators designed for longer timeframes on shorter charts (or vice versa) leads to false signals and poor trade timing.

The Solution: Match your indicators to your timeframe. A 200-period moving average on a 5-minute chart represents different market information than the same MA on a daily chart.

Building Your Personal Timeframe Trading Plan

Step 1: Honest Self-Assessment

Before choosing your primary timeframes, ask yourself these critical questions:

- How much time can I realistically dedicate to trading each day?

- What’s my risk tolerance for individual trades?

- How quickly do I need to see results?

- What’s my available trading capital?

- Do I prefer frequent small profits or occasional large gains?

Step 2: Timeframe Selection Matrix

Based on your self-assessment, use this matrix to guide your timeframe selection:

| Trading Style | Primary Timeframe | Secondary Timeframe | Trading Frequency | Capital Required |

|---|---|---|---|---|

| Scalping | 1-5 minutes | Tick-1 minute | 10-50 trades/day | $5,000+ |

| Day Trading | 15-60 minutes | 5-15 minutes | 2-10 trades/day | $2,500+ |

| Swing Trading | 4-hour to Daily | 1-4 hours | 2-5 trades/week | $1,000+ |

| Position Trading | Daily to Weekly | 4-hour to Daily | 1-5 trades/month | $500+ |

Step 3: Testing and Refinement

Start with paper trading or micro lots to test your chosen timeframes. Track these metrics:

- Win rate by timeframe

- Average profit/loss per timeframe

- Maximum drawdown periods

- Stress levels during trading

- Time commitment required

After 2-3 months of consistent data, you’ll have clear evidence of which timeframes work best for your situation.

The Psychology of Timeframe Trading

Managing Emotions Across Different Timeframes

Each timeframe creates different psychological challenges:

Short Timeframes: High stress, quick decisions, frequent wins and losses. The challenge is maintaining discipline amid constant action.

Medium Timeframes: Balanced stress levels but require patience for setups. The challenge is avoiding premature exits during normal market fluctuations.

Long Timeframes: Low stress but require significant patience. The challenge is staying committed during extended drawdown periods.

Developing Timeframe-Specific Mindsets

I’ve learned to adopt different mental approaches for different timeframes:

Scalping Mindset: Mechanical execution, no emotional attachment to individual trades, focus on overall performance.

Swing Trading Mindset: Strategic patience, trust in analysis, acceptance of temporary unrealized losses.

Position Trading Mindset: Fundamental conviction, long-term perspective, immunity to short-term noise.

Technology and Tools for Multi-Timeframe Analysis

Essential Software Features

Modern trading platforms offer sophisticated multi-timeframe analysis tools:

Synchronized Charts: Multiple timeframes of the same pair updating simultaneously.

Alert Systems: Notifications when setups develop across different timeframes.

Custom Indicators: Tools designed specifically for multi-timeframe analysis.

Template Saving: Quickly switch between different timeframe analysis setups.

Mobile Trading Considerations

With mobile trading becoming increasingly popular, timeframe selection becomes even more critical:

Longer Timeframes Work Better: Daily and 4-hour charts are easier to analyze on small screens.

Alert Dependency: Mobile traders rely heavily on pre-set alerts for entry signals.

Simplified Analysis: Complex multi-timeframe strategies are difficult to execute on mobile devices.

Frequently Asked Questions

What timeframe should beginners start with?

New forex traders should start with 1-hour and 4-hour timeframes. These provide enough price movement to be interesting while giving you time to think and make decisions without panic. They also offer clear technical patterns that are essential for learning chart analysis. Avoid scalping timeframes until you’ve mastered the basics, as the speed and pressure can lead to poor decision-making and rapid account depletion.

Can you use multiple timeframes simultaneously?

Absolutely, and I highly recommend it. Professional traders typically analyze 3-4 timeframes for each trade decision. Use higher timeframes (daily/weekly) to identify trend direction and major support/resistance levels, medium timeframes (1-4 hours) to spot specific trading setups, and shorter timeframes (15-30 minutes) for precise entry timing. This approach dramatically improves your success rate by ensuring all time horizons support your trade.

How does timeframe affect stop-loss placement?

Timeframe directly influences stop-loss size and placement. Shorter timeframes require tighter stops (5-20 pips) because you’re trading smaller price movements, while longer timeframes need wider stops (50-200 pips) to account for normal market volatility. The key is matching your stop-loss to the timeframe’s natural price swing range. A 10-pip stop on a daily chart will get hit by normal market noise, while a 100-pip stop on a 5-minute scalp is excessive.

Which timeframe is most profitable?

There’s no universally “most profitable” timeframe – profitability depends on your skill, strategy, and consistency rather than timeframe choice. However, many professional traders gravitate toward 4-hour and daily timeframes because they offer the best balance of opportunity frequency and signal reliability. These timeframes provide enough trading opportunities while filtering out much of the market noise that plagues shorter timeframes.

How do news events affect different timeframes?

Major news events create immediate volatility that affects all timeframes, but the impact varies significantly. Short timeframes (1-15 minutes) show extreme spikes and reversals during news releases, creating both opportunities and risks for scalpers. Medium timeframes (1-4 hours) often show the sustained follow-through moves after initial news reactions. Long timeframes (daily+) incorporate news effects into broader trend movements, making individual announcements less critical for position traders.

Should swing traders use intraday timeframes?

Swing traders should use intraday timeframes for entry timing and trade management, even though their main analysis occurs on daily and weekly charts. For example, a swing trader might identify a setup on the daily chart but use the 1-hour chart to pinpoint the optimal entry point during a pullback. This multi-timeframe approach improves entry prices and reduces risk while maintaining the swing trading strategy’s core principles.

Conclusion

Mastering timeframes in forex trading isn’t just about choosing charts – it’s about finding your trading rhythm, matching your strategy to your lifestyle, and understanding how time influences every aspect of market analysis. Throughout this comprehensive guide, we’ve explored how different timeframes serve different purposes, from the lightning-fast world of scalping to the patient approach of position trading.

The key insights you should take away are clear: there’s no one-size-fits-all timeframe solution. Your optimal timeframe depends on your available time, risk tolerance, capital, and psychological makeup. The most successful traders I know have found their sweet spot and mastered it completely before branching out to other timeframes.

Remember the fundamental principles we’ve covered: higher timeframes provide direction and reduce noise, lower timeframes offer precise entries and quick profits, and multi-timeframe analysis creates the most complete market picture. Whether you’re drawn to the adrenaline rush of 1-minute scalping or the strategic patience of daily chart analysis, consistency in your chosen approach beats jumping between timeframes.